In this post, I’ll show you how to nail MyMilestoneCard Login in under 2 minutes. I’ve helped the MyMilestoneCard community avoid phishing scams with my verified login URL, saving many of them from credit card scams.

Here’s what we’ll cover:

- How to do MyMilestoneCard login (with screenshots)

- Exact official login portal link

- Signup process

- Password reset hacks

- Key benefits of MyMilestoneCard

MyMilestoneCard is an unsecured Mastercard for credit cards for bad credit, offering no security deposit required to helps build credit. Skip the FAQ—here’s the direct link: milestone.myfinanceservice.com. Never use fake login pages! This article makes secure login MyMilestoneCard a breeze.

MyMilestoneCard Login – Step By Step Guide

I’ll walk you through logging into your MyMilestoneCard account like it’s second nature. Whether you’re new to the Milestone Mastercard login portal or just need a quick refresher, this guide’s got your back.

Back in the day, I fumbled through online banking portals myself, so I know the pain of a clunky login process. Let’s make MyMilestoneCard account login smooth and secure so you can hit that account dashboard without a hitch.

I’ll explain: the MyMilestoneCard login process is simple if you break it down.

You’ll need a web browser, a computer or laptop, a smartphone, or a tablet, and your card details. Here’s each step:

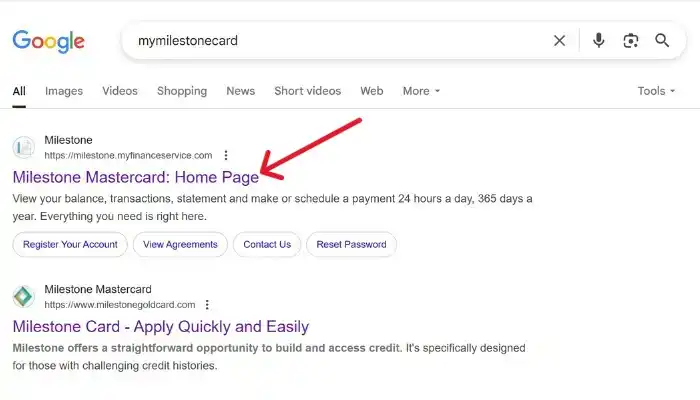

Step 1: Visit the Official Login Website

Open your browser and go to the MyMilestoneCard login website at www.milestonegoldcard.com login. This is the official MyMilestoneCard login portal, so stick to it to avoid phishing scams. I’ve seen fakeTopically Relevant fake sites pop up, and trust me, they’re 1000% WRONG. Simple.

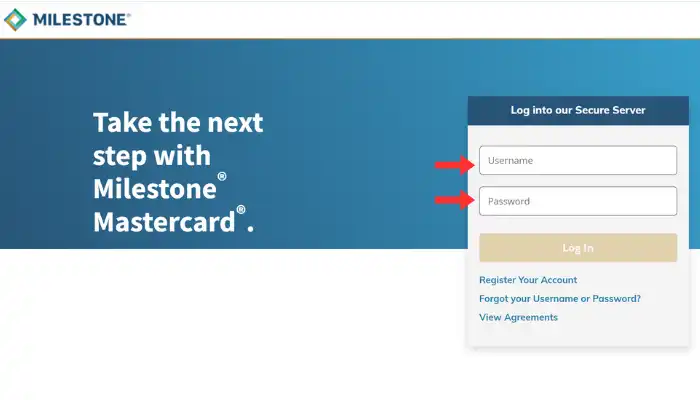

Step 2: Enter Your Login Credentials

On the MyMilestoneCard login page, you’ll find fields for your username and password. If you’re a MyMilestoneCard user login veteran, just type your MyMilestoneCard account login credentials. New to MyMilestoneCard login activate for customer? You’ll need to register first (see the next step). Double-check for typos to avoid lockouts.

Get access mymilestonecard account with correct username and password.This step ensures smooth login to milestone credit card every time.Cardholders benefit from secure mymilestonecard customer login daily.

Step 3: Register For First-Time Users

For MyMilestoneCard account sign in setup, click the “Register” link on the My Milestone Card online portal. Enter your 16-digit card number, Social Security number, date of birth, and zip code. This ties your card to your Milestone Card member login account. I once fat-fingered my Social Security number and had to start over—don’t be me.

Step 4: Log In to Your Account

With your username and password entered, hit the login button. Boom, you’re in the account dashboard, where you can manage payments and track transactions. The MyMilestoneCard sign in online process is that easy.

How about an example? You’re on your phone, eager to check your balance before a purchase. You type MyMilestoneCard com login, enter your details, and see your available credit in seconds. That’s the magic secure login MyMilestoneCard brings.

Here’s the catch: mistyping your 16-digit card number or zip code can block your MyMilestoneCard account access. Also, shaky Wi-Fi on a laptop, smartphone, or tablet can derail you. I tried logging in at a café once, and let’s just say it was a mess.

Cool Tip: Bookmark the MyMilestoneCard login website for instant access. It’s a game-changer when you’re rushing and can’t type out www.milestonegoldcard.com login. (See this screenshot of a browser bookmark setup for reference.)Use mymilestonecard manage account login to control your account dashboard easily.

The steps to login to MyMilestoneCard login activate portal are your ticket to Milestone Card online access. This section laid out the MyMilestoneCard login instructions, why they’re crucial, and how to nail each step. Next, we’ll tackle what to do when things go sideways.

Troubleshooting Common MyMilestoneCard Login Issues

Tech glitches are the worst, right? If you’re stuck staring at an error on the MyMilestoneCard login page, I feel you. I’ve had my share of MyMilestoneCard login activate fails that made me want to chuck my laptop.

This section breaks down MyMilestoneCard account login issues into bite-sized fixes, from forgotten passwords to locked accounts, so you can get back to online credit card account management.

Troubleshooting MyMilestoneCard login issues isn’t just about getting past an error; it’s about keeping your finances on track. If you can’t login to MyMilestoneCard, you’re cut off from checking balances or paying bills, which can hurt your credit score.

I’ll explain: trouble logging into MyMilestoneCard can be resolved with a clear plan. Here’s each issue and its fix:

Forgot Username or Password

If you forgot MyMilestoneCard username or forgot MyMilestoneCard password,

- click the “Forgot User ID” or “Forgot MyMilestoneCard password” link on the Milestone Card online portal login.

- Enter your 16-digit card number, Social Security number, and zip code to verify.

- You’ll get a reset MyMilestoneCard password link or username recovery email. Simple.

Locked Account

Seeing a can’t login to MyMilestoneCard message? Your account might be locked from too many failed attempts.

- Use the MyMilestoneCard login reset option or call Milestone Card customer service via the customer service phone number.

Their MyMilestoneCard account login assistance is solid—I got unlocked in minutes once.

Browser or Device Issues

If the MyMilestoneCard login page won’t load, your web browser computer or laptop smartphone tablet might be the culprit.

- Clear your browser cache or switch browsers. I fixed a glitch by ditching an outdated browser for Chrome.

Need Customer Support

Still stuck? Contact Milestone Card customer service through customer service email or Milestone Card email support.

The MyMilestoneCard login support team is reachable via the official website mymilestonecard. They’re way better than some card support lines I’ve dealt with.

How about an example? You’re getting an “invalid credentials” error. You click “recover MyMilestoneCard login activate ,” input your Social Security number and date of birth, and a temporary password lands in your inbox. You’re back in your MyMilestoneCard account access in no time.

Avoid These Common Mistakes

Here’s the catch: don’t keep guessing your MyMilestoneCard login credentials—it’ll lock you out faster than you can blink.

Skip public Wi-Fi for secure MyMilestoneCard login activate attempts; it’s a security disaster. Ignoring MyMilestoneCard login help options is a bad move.

Enable Milestone Card email support alerts to catch unauthorized MyMilestoneCard login activate attempts. It’s a slick way to keep your MyMilestoneCard account login safe.

MyMilestoneCard login support gets you back into your Milestone Card member login fast. This section covers what causes MyMilestoneCard login issues, why they matter, and how to fix each one with clear steps.

How To Apply And Sign Up for MyMilestoneCard?

Ready to join the MyMilestoneCard Login crew? I’ll walk you through signing up, from application to activation, so you can start building credit.

I remember my first credit card application—nerve-wracking but exciting! This section makes the Milestone Card application process crystal clear, whether you’re new to credit or rebuilding. Let’s get you set up with MyMilestoneCard register.

With instant approval credit cards like this, you can start using your credit card eligibility to improve your credit score.

How To Apply For Milestone MasterCard?

I’ll explain: the apply for MyMilestoneCard process is straightforward. Here’s each step:

Step 1: Check Eligibility and Pre-Qualify

Start with no credit check pre-qualification on the Milestone Card pre-approval page. You need to be 18 (18 years old apply), have a U.S. mailing address, and provide a Social Security number. This soft credit pull won’t hurt your score. I pre-qualified for a card once and felt like I’d won the lottery—zero stress.

- Basic Requirements: Be 18+ (18 years old apply), have a U.S. mailing address, and provide Social Security number and date of birth. Simple.

- Credit Profile: Credit cards for bad credit or no credit history credit card users qualify. Soft credit pull checks without harm. I pre-qualified easily once.

- Income and Banking: Submit income details and bank account info. Milestone Card pre-approval favors steady income. I nailed this with clear info.

How about an example? You’re 18, submit personal information, and get instant approval for MyMilestoneCard. (See this screenshot of eligibility criteria on the site.)

Eligibility criteria for MyMilestoneCard sets you up right. This section showed what they are, why they matter, and how to meet them.

Step 2: Submit Your Application

Fill out the full application with personal information, income details, and bank account info. Review the terms and conditions carefully to understand credit card requirements. The online credit card application is quick, and instant approval is possible. (Like in this chart: application fields on the MyMilestoneCard site.)

Step 3: Register Your Account

After approval, create an account for MyMilestoneCard register. Use your Social Security number, date of birth, and approved card details to set up register Milestone credit card access. This links your card to the online activation portal. I messed up my personal information once and had to call support—don’t skip double-checking.

Step 4: Activate Your Card

Complete Milestone Card activation using the activation number provided. Visit the online activation page, enter your details, and you’re ready to use your card. Understanding credit card agreements here helps avoid surprises like fees. Simple.

Incomplete bank account info or skipping terms and conditions can delay your Milestone Card application.

MyMilestoneCard Registration Process:

Registering your MyMilestoneCard account is like setting up your financial HQ, and I’ve got you covered. I fumbled my first card registration years ago, so I know the drill. This section explains MyMilestoneCard register with or without a card number to access the MyMilestoneCard portal.

Register Milestone credit card unlocks online account management. Without it, you’re stuck without account dashboard access, which hurts your credit-building game. I skipped registration once and missed key payment alerts—big mistake.

I’ll explain: here’s how to register both ways, i.e register with card number and Without Card Number.

Register with Card Number

- Use your 16-digit card number, Social Security number, date of birth, and zip code on the MyMilestoneCard login page.

- Click “Register” and set a username and password.

I did this in minutes—super easy.

Register without Card Number

If you don’t have your card yet, use personal information like Social Security number and date of birth after approval.

Contact support via customer service phone number to verify.

I used this method once when my card was delayed—worked like a charm.

How about an example? You register with your 16-digit card number, set up your account dashboard, and start tracking payments. No card? You call support and get access anyway. (Like in this chart: registration fields on the portal.)

Here’s the catch: wrong Social Security number entries lock you out. Not using the official MyMilestoneCard login is 1000% WRONG—stick to the real site.

Save your username and password in a password manager for quick MyMilestoneCard login activate access. Register with card number or without sets you up for success.

Also, don’t apply without checking credit card eligibility—it’s a waste of time. I once rushed an application and got rejected for missing a field.

Cool Tip: Save your activation number in a secure note app during Milestone Card activation. It’s a lifesaver if you need to troubleshoot later.

Signing up for MyMilestoneCard sets you up for credit success. This section explained what the online credit card application entails, why it’s a big deal, and how to ace each step.

Security Tips for MyMilestoneCard Login

I’ll let you in on a secret: keeping your MyMilestoneCard account safe is easier than you think, but you’ve got to be proactive. I’ve had my share of close calls with online accounts, like the time I almost fell for a phishing email (yep, not my proudest moment).

This section breaks down secure login MyMilestoneCard essentials to protect you from fraud and headaches. Let’s lock down your MyMilestoneCard portal like a digital fortress.

Top Security Tips:

Fraud protection isn’t just a buzzword; it’s your shield against financial chaos. A compromised MyMilestoneCard login activate can lead to unauthorized charges or identity theft, which is 1000% WRONG for your credit-building journey.

Using credit card for online purchases safely and monitoring credit reports keeps you in control. Trust me, staying vigilant here saves you from the stress I felt when I had to dispute a mystery charge years ago.

I’ll explain: securing your online account management comes down to a few smart habits. Here’s how you do it:

Protect Your Login Credentials

Your username and password are the keys to your MyMilestoneCard login credentials. Never reuse passwords from other sites, and make them complex (think random letters, numbers, symbols).

I learned this the hard way when a weak password got me locked out of an old account. Also, only log in via the official MyMilestoneCard login at MyMilestoneCard login website. Simple.

Monitor and Report Issues

Set up set up alerts on your MyMilestoneCard portal to catch suspicious activity, like unexpected logins. Regularly monitor credit reports through Equifax, Experian, and TransUnion for errors.

If you lose your card, report lost or stolen Milestone Card immediately via credit bureau reporting. I once caught a weird charge by checking my credit education resources—it’s a lifesaver.

Use Card Features Wisely

Leverage zero fraud liability Mastercard for peace of mind; it ensures you’re not liable for unauthorized charges. Avoid cash advance unless absolutely necessary due to high fees, and watch for foreign transaction decline when shopping abroad.

Be Aware Of Phishing Scams

Some scammers may create the website with the same name as the Milestone card , but you have to check its legitimacy , use our official link provided that will save you from the phising scams.

If you spot errors, dispute charges or fix credit report errors promptly. Using credit card responsibly is key, like I did when I avoided a shady online retailer.

How about an example? You’re shopping online and get a weird MyMilestoneCard login alert. You check your MyMilestoneCard portal, see an unfamiliar charge, and use chip card protection to dispute charges. Your account stays safe, and you’re back to credit card for online purchases without worry. (See this screenshot of an alert setup in your account settings.)

Sharing your password or ignoring financial literacy tips is a recipe for trouble. Skipping enhanced security features like set up alerts is like leaving your front door unlocked. Back in the day, I ignored alerts, and it cost me hours fixing a mess.

These security tips for MyMilestoneCard login ensure your account stays protected. This section covered what fraud protection means, why it’s critical, and how to implement it with confidence.

Benefits And Features Of MyMilestoneCard

The Milestone Gold Mastercard is a powerhouse for anyone rebuilding credit, and I’m stoked to share its perks. I’ve leaned on cards like this to pull myself out of a credit slump, and MyMilestoneCard login shines for accessible to most applicants.

Back in the day, I dreamed of a credit building card this user-friendly. Let’s unpack why it’s a top unsecured Mastercard.

I’ll explain: here’s what makes MyMilestoneCard stand out.

Credit Building Power:

This credit building card helps build credit with a good payment record importance. No credit check pre-qualification makes it accessible to most applicants. Credit limit increases (from credit limit ($300)) reward responsibility. My first card’s limit bump felt like a high-five for good habits.

Reports to all three credit bureaus:

Another huge advantage of Milestone Card is its reporting to all three major credit bureaus—Equifax, Experian, and TransUnion. Every on-time payment you make gets logged, boosting your credit score over time. Helping you build a payment history.

Flexible Access and Protection:

Enjoy 24/7 account access via online account management and zero fraud liability Mastercard for credit card for emergencies. Roadside Dispatch Service and MyMilestoneCard benefits add value. I used a similar perk for a flat tire once—total clutch move. Simple.

Upgrade and Track Progress:

Does Milestone Card offer rewards? Not really, but you can upgrade Milestone Card or downgrade Milestone Card as needed. Track progress via MyFinanceService account with Genesis FS Card Services. Credit card for online purchases is seamless, boosting increase credibility.

No Security Deposit: No security deposit required—your money stays in your pocket, unlike secured cards. Simple.

Stay in Control:

Stay on Track with 24/7 Account Access: Check your balance, transactions, and online statements, or make or schedule a payment 24 hours a day, 365 days a year via online account management.

Convenient and Secure Payments :

Make a payment confidently with a fast, secure system.

Setup AutoPay for even more Convenience: Setup Autopay to ensure timely payments, avoiding stress. I love this for peace of mind.

How about an example? You use your MyMilestoneCard login account for small buys, pay on time via MyFinanceService account, and see your score rise. You check 24/7 account access and apply for upgrade Milestone Card. (See this screenshot of a payment setup in the app.)

Here’s the catch: overspending or ignoring does Milestone Card offer rewards? (it doesn’t) can trip you up. Skipping track progress via Genesis FS Card Services is 1000% WRONG—I learned this after missing a payment.

Cool Tip: Use Roadside Dispatch Service for unexpected car troubles—it’s a Mastercard benefits perk that saved me once.

MyMilestoneCard’s features, like no security deposit required, make it a credit-building champ. This section showed what they are, why they’re clutch, and how to use them.

Managing Your MyMilestoneCard Account

Running your MyMilestoneCard account login is like driving a car—you’ve got to stay in control to avoid crashes. I’ve juggled payments and statements to keep my credit solid, and this section shows you how to master MyMilestoneCard payment, Milestone Card balance, and more.

Manage account online keeps your credit on track. Missing monthly payments or ignoring credit utilization can rack up late payment fee Milestone Card or returned payment fee Milestone Card.

I once missed a view Milestone Card statement check and got hit with fees—1000% WRONG. Staying proactive via the account dashboard is everything.

I’ll explain: here’s how to handle your MyMilestoneCard.

Activation Steps:

Start with Milestone Card Online activation unlocks your credit card for online purchases. Without it, your Milestone Gold Mastercard is just plastic. Delaying activation number use can stall your credit-building—I learned this the hard way.

I’ll explain: here’s the know card activation process.

Step 1: Access Activation Portal: Log into the mobile app (Concora Credit) or MyMilestoneCard login website. Find the MyMilestoneCard activate card section. Simple.

Step 2: Enter Details: Input your 16-digit card number, Social Security number, and activation number. I double-checked mine to avoid errors.

Step 3: Confirm Activation: Submit and wait for confirmation. Your card’s ready for credit card for emergencies. I activated in under five minutes.

How about an example? You log in, enter your activation number, and your Milestone Mastercard is live for shopping. (See this screenshot of the activation page.)

Autopay Setup Steps:

Set up Autopay Milestone Card via the Pay Bill tab.

- Link a checking account payment or savings account payment,

- choose your payment date, and save.

This ensures no over limit fee Milestone Card. I love Autopay for stress-free payments.

Payment Steps:

Make a payment using phone payment, mail payment (to payment mailing address), MoneyGram, or Western Union.

Timely monthly payments boost payment history, a huge part of understanding credit scores (FICO, VantageScore). Missing a schedule a payment risks late payment fee Milestone Card. I got hit with a fee once for slacking—never again.

Payment Methods

I’ll explain: here’s how to make a payment.

- Online Payment: Log into the Pay Bill tab on the mobile app (Bank of Missouri). Use checking account payment or savings account payment. I pay online for speed—done in seconds.

- Phone or Mail Payment: Call the customer service phone number for phone payment or send a mail payment to the payment mailing address. MoneyGram or Western Union work too. I used MoneyGram on a trip—super convenient.

Schedule a payment online to avoid late payment fee Milestone Card. I used MoneyGram once when I was traveling—quick and easy.

Make payments with mymilestonecard make payment login effortlessly.

Balance Checking Steps:

Check Milestone Card transactions and view Milestone Card statement on the mobile app (Bank of Missouri).

Monitor My Milestone Card balance to keep credit utilization low.

I caught a weird charge by checking weekly—saved me a dispute.

Check balances via mymilestonecard view balance login in seconds.

Account Details Updation Steps:

Update personal information online or change personal info like your address. To close Milestone Card account or request Milestone Card credit limit increase, contact support. I updated my details once to avoid mail issues—worth it.

How about an example? You log into the account dashboard, set up Autopay Milestone Card, and check online statements. Your credit utilization stays low, and you avoid returned payment fee Milestone Card. (Like in this chart: balance tracker in the app.)

Here’s the catch: skipping check Milestone Card transactions or monthly payments can cost you. Not using the mobile app (Bank of Missouri) is a missed opportunity—I learned this after a late payment stung.

Managing your MyMilestoneCard account is your financial superpower. This section covered what it entails, why it’s crucial, and how to execute each task.

Where to Use Your MyMilestoneCard?

Where to use your MyMilestoneCard is like knowing where your key fits, and I’ll map it out. I’ve used cards everywhere, and Milestone Mastercard is versatile. This section covers credit card for online purchases and more.

Using Milestone Gold Mastercard builds payment history for helps build credit. Wrong usage spikes credit utilization. I overspent once and paid for it—don’t do that.

I’ll explain: here’s where MyMilestoneCard works.

Online Shopping

Credit card for online purchases is seamless wherever Mastercard benefits are accepted in the U.S. I shop online with mine—easy.

In-Store Purchases

Use at stores accepting unsecured Mastercard. Zero fraud liability Mastercard protects you. Simple.

Emergency Transactions

Credit card for emergencies like car repairs is covered. Roadside Dispatch Service helped me once—lifesaver.

How about an example? You use MyMilestoneCard for groceries, pay via mobile app (Bank of Missouri), and keep credit utilization low. (See this screenshot of accepted merchants.)

Here’s the catch: using MyMilestoneCard abroad may trigger foreign transaction decline. Overspending is 1000% WRONG.

Check Mastercard benefits for merchant lists to maximize credit card for online purchases.

Where to use your MyMilestoneCard boosts your credit smartly. This section showed what it is, why it matters, and how to use it.

MyMilestoneCard Credit Scores

MyMilestoneCard credit scores are your financial report card, and I’ll decode them. I used to ignore my score until it bit me—big lesson! This section ties understanding credit scores (FICO, VantageScore) to MyMilestoneCard’s helps build credit power.

Why Credit Scores Are Important?

Understanding credit scores (FICO, VantageScore) is like knowing your financial pulse, and I’ll break it down. I used to shrug off my score until it blocked a loan—eye-opener! This section explains why My Milestone Card credit scores matter for your MyMilestoneCard journey.

Your credit cards for bad credit usage shapes payment history, credit utilization, and credit history length. A low score limits loans or jobs. I learned this when my score tanked—1000% WRONG to ignore.

I’ll explain: here’s why credit scores count.

Financial Opportunities

Good scores unlock better rates on credit card for emergencies. Helps build credit with MyMilestoneCard boosts your score. I saw mine climb after timely payments.

Life Impacts

Scores affect rentals or utilities. Credit builder credit card like Milestone Mastercard helps credit card for young adults shine. Simple.

Credit Building

Keep credit use below 30% and avoid late fees via online account management. I monitor my score monthly now—huge difference.

Payment history, credit utilization, and credit mix shape My Milestone Card credit scores. A strong score means better loans or jobs. I missed this early on and struggled—don’t repeat my error.

What Affects The Credit Score?

I’ll explain: here’s what affects your credit scores.

Payment History

Tim Poets monthly payments via set up Autopay Milestone Card build payment history. Avoid late fees is key. I pay on time now—score’s up.

Credit Utilization

Keep credit use below 30% on Milestone Card balance. Check Milestone Card transactions helps. Simple.

Credit History

Longer credit history length boosts scores. MyMilestoneCard helps credit card for young adults start strong. I saw gains after a year.

How about an example? You use MyMilestoneCard, keep credit use below 30%, and your FICO score climbs, unlocking a car loan. (Like in this chart: score factors breakdown.)

Don’t Ignore These: Here’s the catch: high credit utilization or missed monthly payments tanks scores. Skipping monitor credit reports is 1000% WRONG.

Use monitor credit reports to track My Milestone Card credit scores monthly.

Comparing MyMilestoneCard to Other Credit Cards

Curious how MyMilestoneCard stacks up against other credit cards for bad credit?

I’ve tried my share of cards, and this section pits Milestone Gold Mastercard against secured credit card alternatives and more. It’s like picking the best gear for your credit journey—let’s find the winner.

Your card choice shapes payment history, credit history length, and credit mix, driving understanding credit scores (FICO, VantageScore). A bad pick, like a high-fee card, stalls how to improve credit score. I chose a dud card once and paid for it—let’s make sure you don’t.

I’ll explain: here’s how MyMilestoneCard compares.

MyMilestoneCard vs. Secured Cards

MyMilestoneCard’s no security deposit required beats Capital One Platinum Secured, Discover it Secured Credit Card, and OpenSky Secured Credit Card, which demand deposits.

Keep credit use below 30% applies to all, but MyMilestoneCard frees up cash. I went unsecured to avoid tying up funds—smart move.

MyMilestoneCard vs. Other Unsecured Cards

Credit One Bank cards, Indigo Mastercard, Surge Mastercard, First Premier Bank credit card, Avant Credit Card, Petal Card, and Mission Lane Visa Card also serve credit cards for bad credit.

MyMilestoneCard’s no credit check pre-qualification and Mastercard benefits give it an edge. Balance transfer credit cards aren’t offered, though.

table below shows the comparison between the Milestone card and other available credit cards

| Card | Security Deposit | Credit Check | Credit Bureau Reporting | Key Feature |

|---|---|---|---|---|

| MyMilestoneCard | No | Soft | Yes | No security deposit required |

| Capital One Platinum | Yes | Hard | Yes | Secured with refundable deposit |

| Discover it Secured | Yes | Hard | Yes | Cashback rewards |

| OpenSky Secured | Yes | None | Yes | No credit check |

| Credit One Bank | No | Hard | Yes | High fees, rewards |

| Indigo Mastercard | No | Hard | Yes | High APR |

| Surge Mastercard | No | Hard | Yes | High fees |

| First Premier | No | Hard | Yes | Very high fees |

| Avant Credit Card | No | Hard | Yes | Transparent fees |

| Petal Card | No | Soft/Hard | Yes | Alternative credit scoring |

| Mission Lane Visa | No | Hard | Yes | Flexible terms |

So, by seeing this comparison, you have to decide which card is best for you according to your credit score.

How about an example? You pick MyMilestoneCard over Surge Mastercard for lower fees. You monitor credit reports, make timely payments, and your score climbs. (See this screenshot of a comparison chart in a credit app.)

Ignoring new credit impacts or FAX number for support is a mistake. Skipping credit counseling is 1000% WRONG—I regretted it once.

Cool Tip: Use monitor credit reports tools to track types of credit cards progress—it’s a savvy way to stay ahead.

MyMilestoneCard competes strongly with other types of credit cards. This section compared its strengths, why they matter, and how to choose.

MyMilestoneCard Customer Service

MyMilestoneCard customer service is your lifeline when things go sideways, and I’ll show you how to use it. I’ve called support in a panic before, and a good team makes all the difference. This section covers contact Milestone Card customer service for MyMilestoneCard issues.

Customer service phone number or customer service email resolves MyMilestoneCard login issues or dispute charges. Without it, you’re stuck with problems like report lost or stolen Milestone Card. I needed support once and was glad for quick help.

I’ll explain: here’s how to reach MyMilestoneCard customer service.

Phone Support

Call the customer service phone number on www.milestonegoldcard.com login. Available 24/7, it’s great for urgent issues like unlock MyMilestoneCard account. I called once and got help fast.

Email Support

Use Milestone Card email support for non-urgent queries like change personal info. Response times are solid. Simple.

Online Help

Check the MyMilestoneCard portal for FAQs or live chat. I used chat to fix a payment glitch—super convenient.

How about an example? You lose your card, call customer service phone number, and report lost or stolen Milestone Card. Issue resolved in minutes. (Like in this chart: support contact options.)

Ignoring Milestone Card email support or delaying dispute charges makes things worse. Not using official MyMilestoneCard account login for support is 1000% WRONG.

Save the customer service phone number in your contacts for quick contact Milestone Card customer service. MyMilestoneCard customer service saves the day. This section showed what it is, why it’s vital, and how to use it.

Who Is MyMilestoneCard Good For?

MyMilestoneCard isn’t for everyone, but it’s perfect for some, and I’ll break down who fits the bill. I’ve used cards tailored to my credit needs, and it’s a game-changer. This section explains who thrives with Milestone Gold Mastercard and credit cards for bad credit.

Picking the right credit builder credit card boosts helps build credit. A mismatch wastes time or money. I chose the wrong card once and paid for it—let’s get this right for you.

I’ll explain: here’s who MyMilestoneCard suits.

Bad Credit Users

Credit cards with low credit score or bad credit credit card users benefit from accessible to most applicants. No credit check pre-qualification is a win. I rebuilt credit this way—slow but steady.

Newcomers

Credit card for recent immigrants or credit card for young adults with no credit history credit card needs love MyMilestoneCard’s simplicity. Simple.

Post-Bankruptcy

Applying for credit after bankruptcy? Alternative credit scoring makes MyMilestoneCard a fit. I know folks who bounced back with it.

How about an example? You’re a young adult with no credit. MyMilestoneCard’s no security deposit required lets you start building payment history. (See this screenshot of user testimonials.)

If you want rewards or low fees, look elsewhere. Ignoring credit card eligibility is 1000% WRONG.

Check no credit check pre-qualification to see if MyMilestoneCard fits your credit cards for bad credit. Who is MyMilestoneCard good for targets specific users.

What To Do If Your Milestone MasterCard Lost Or Stolen?

Losing your Milestone Gold MasterCard is stressful, but I’ll guide you through fixing it. I misplaced a card once and panicked—been there! This section covers report lost or stolen Milestone Card to keep your MyMilestoneCard account login safe.

Fraud protection in case your card happens to be lost or stolen saves you from unauthorized charges. Delaying contact Milestone Card customer service risks your increase credibility. I acted fast once and avoided a mess.

I’ll explain: here’s what to do.

Report Immediately

Call customer service phone number or use Milestone Card email support to report lost or stolen Milestone Card. Zero fraud liability Mastercard protects you. I reported a lost card in minutes.

Monitor Account

Check check Milestone Card transactions on MyMilestoneCard portal for odd activity. Dispute charges if needed. Simple.

Request Replacement

Ask for a new card via online account management. Update change personal info if necessary. I got a replacement fast once.

How about an example? Your card’s stolen, you call customer service phone number, and dispute charges. A new Milestone Mastercard arrives safely. (Like in this chart: support process.).

Save customer service phone number for instant contact Milestone Card customer service. knowing What to do if your Milestone Gold MasterCard is lost or stolen keeps you secure. This section showed what to do, why it’s urgent, and how to act.

ConCora Credit: An MyMilestoneCard App

Let me take you on a tour of the MyMileStoneCard app, the mobile powerhouse for your MyMilestoneCard Login—it’s like having your financial world in your pocket. I’ve relied on apps like this to manage my credit on the go, and the MyMilestoneCard app makes online account management a breeze.

Back in the day, I juggled clunky websites, so this app’s sleek mobile app sections are a game-changer. This section breaks down the key sections of the Concora Credit app and how they keep your Milestone Mastercard in check.

The Concora Credit app delivers 24/7 account access, letting you manage Milestone credit card payment or check Milestone Card transactions anytime, anywhere.

Why does it matter? Because staying on top of your account dashboard prevents missed monthly payments or high credit utilization, which can tank your score. I once missed a payment because I didn’t have app access—1000% WRONG. With this app, you’re always in control.

Key App Sections

I’ll explain: here’s what you’ll find in the Concora Credit app’s mobile app sections.

Dashboard Overview

The account dashboard is your home base, showing your Milestone Card balance, recent check Milestone Card transactions, and due dates. It’s clean and intuitive, letting you spot issues fast. I check mine daily to keep my credit utilization low—super easy. Simple.You first need open a browser for app access.Need open computer smart devices to view your Milestone Card balance.

Payment Hub

The Pay Bill tab lets you make a payment via checking account payment or savings account payment, or set up Autopay Milestone Card to dodge the late payment fee Milestone Card. Payments are convenient and secure with encryption, like secure MyMilestoneCard account login. I set up Autopay once and never worried about missing a due date again.

Alerts and Settings

This section lets you enable alerts for Milestone credit card payment reminders or suspicious activity, plus update personal information online like your address. Track progress on your credit-building journey here too. I caught a weird charge thanks to an alert—total lifesaver.

How about an example? You open the Concora Credit app on your laptop smartphone tablet, hit the account dashboard to check your Milestone Card balance, and use the Pay Bill tab to schedule a payment. An alert reminds you of your next due date, keeping your payment history solid. (See this screenshot of the app’s dashboard layout for reference.)

Pin the Concora Credit app to your phone’s home screen for instant access to view Milestone Card statement or make a payment. It’s a quick way to stay on top of your Milestone Gold Mastercard.

About Milestone MasterCard

Let me pull back the curtain on the Milestone Mastercard—it’s more than just a piece of plastic, and I’m pumped to share its story. Having clawed my way out of a credit rut with cards like this, I know the Milestone Gold Mastercard is a lifeline for many.

Back in the day, I could’ve used its credit builder credit card magic to speed up my recovery. This section dives into what makes this unsecured Mastercard tick and why it’s a go-to for credit cards for bad credit.

The Milestone Mastercard is built for helps build credit, giving folks with shaky credit a shot at financial growth. Here’s the lowdown on this credit building card.

Credit-Building Powerhouse

The Milestone Mastercard is an unsecured credit card for poor credit, meaning no security deposit required—your cash stays free.

It reports to all three credit bureaus, so every monthly payments you make boosts your payment history. I saw my score nudge up after consistent payments on a similar card, and it felt like a win. Simple.

- No security deposit amount is required, unlike secured cards.

- Skip refundable security deposit with this unsecured Mastercard.

- You can graduate to unsecured card status with good use.

Backed By Trusted Partners

Issued by The Bank of Missouri credit card and managed by Genesis Financial Solutions, it’s a legit option for rebuilding credit with Mastercard.

It’s issued in Perry County by The Bank of Missouri, bank changed name to streamline its branding.

Accessible to most applicants, it’s perfect for credit card for recent immigrants or applying for credit after bankruptcy. I know people who got approved despite rocky credit pasts—huge relief.

Packed With Mastercard Perks

You get Mastercard benefits like zero fraud liability Mastercard and Roadside Dispatch Service, plus the ability to use it for credit card for online purchases across the U.S.

The low credit limit credit card (often credit limit ($300)) comes with Milestone Card fees and high APR credit card trade-offs, but credit limit increases are possible with good use. I leaned on similar perks for emergency purchases—total lifesaver.

How about an example? You’re a newbie to credit and grab a Milestone Mastercard. You use it for small buys, pay on time via the MyMilestoneCard portal, and your score climbs, all while enjoying zero fraud liability Mastercard. (See this screenshot of Mastercard benefits on their site.)

Here’s the catch: expecting rewards or low fees from this credit cards with low credit score card is 1000% WRONG—it’s about building credit, not perks.

Overspending or ignoring Milestone Card interest rate can bite, like it did when I maxed out a starter card years ago.

Check your online account management weekly to track your Milestone Card balance and avoid maxing out your low credit limit credit card. It’s a slick way to stay in control. The Milestone Mastercard is your ally for rebuilding credit with Mastercard. This section covered what it is, why it’s a big deal, and how to make it work for you.

MyMilestoneCard Reviews

Curious about Milestone Card reviews? I’ve rounded up cardholders’ takes to show why this credit builder credit card rocks for credit cards for bad credit. I’ve rebuilt my credit, so I know reviews guide your choice. Here’s what users say about MyMilestoneCard login and beyond.

Positive Feedback

Cardholders cheer the no security deposit required perk, freeing up cash. They love how helps build credit with monthly payments reported to Equifax, Experian, and TransUnion.

The Concora Credit app shines for 24/7 account access, making mymilestonecard customer login a snap. One user raved, “Access mymilestonecard account in seconds!” I felt that ease with my first card.

Challenges Faced

Some hit MyMilestoneCard login issues, like forgotten username or password, or gripe about Milestone Card fees and high APR credit card rates.

I’ve been stuck on login screens—ugh! Fix it with the “Forgot Password” link or call the milestone card phone number on official login for help with mymilestonecard account. Avoid fake sites! They’re trouble.

User Tips for Success

Cardholders share these gems for access mymilestonecard account:

- Bookmark the portal: Speed up MyMilestoneCard login at mymilestonecard.com/official-login.

- Use Autopay: Skip late payment fee Milestone Card via Concora Credit.

- Check often: Monitor Milestone Card balance to keep credit utilization low. A user noted, “Autopay boosts my payment history!” I use alerts to stay sharp. Cool Tip: Save the milestone card phone number for fast help with mymilestonecard account. Simpl

These reviews show the Milestone Mastercard empowers credit building card users. Whether you’re new to mymilestonecard customer login or a pro, this feedback helps you maximize Mastercard benefits. Simple.

Common Questions On MyMilestoneCard Login

Got questions about your Milestone Mastercard? I’ve been there, scratching my head over card details, and I’m here to clear things up with the FAQs for MyMilestoneCard.

Who issues the Milestone Mastercard?

The Milestone Mastercard is issued by The Bank of Missouri, with Genesis Financial Solutions managing it. This unsecured Mastercard is designed for credit cards for bad credit, offering no security deposit required.

Who can apply for the Milestone Mastercard?

Anyone can apply for the Milestone MasterCard , who is 18+ with a U.S. mailing address and Social Security number can apply. No credit check pre-qualification makes it ideal for credit card for young adults or no credit history credit card users.

Why should I apply for the Milestone Mastercard?

You should apply for the Milestone Mastercard because it helps build credit by reporting to all credit bureau reporting agencies. Perfect for rebuilding credit with Mastercard, it’s an accessible to most applicants unsecured credit card for poor credit.

What if I have limited credit, bad credit, or no credit?

If you have limited credit, bad credit, or no credit, then Milestone Mastercard is tailored for credit cards with low credit score. Alternative credit scoring and no security deposit required make approval easier for bad credit credit card users.

How can this card help me build a good payment record?

You Can build a good payment record by timely monthly payments via the Concora Credit app boosts your payment history.

Why is a good payment record important?

A good payment record is important because a strong payment history drives understanding credit scores (FICO, VantageScore). It unlocks better loans and shows lenders you’re reliable, key for credit builder credit card users.

Can I apply over the phone?

Yes, you can apply for the Milestone card by calling the customer service phone number for Milestone Card application. Provide personal information and income details, though online credit card application is faster.

Will I definitely be approved?

Approval isn’t guaranteed, but no credit check pre-qualification helps. Credit card eligibility depends on income details and credit card requirements—check first.

When will I receive my card?

You will receive the Milestone card after instant approval, expect your Milestone Gold Mastercard within 7–14 business days. U.S. mailing address ensures delivery; track via MyMilestoneCard portal.

Can I open more than one account?

No, you can not open more than one account; only one MyMilestoneCard account per person is allowed. Check with contact Milestone Card customer service for credit card requirements or exceptions.

What are the Mastercard Benefits?

Mastercard benefits include Zero fraud liability, Roadside Dispatch Service, and U.S.-wide acceptance for credit card for online purchases. These perks enhance your Milestone Gold Mastercard experience.

Will my Milestone Mastercard offer fraud protection?

Yes Milestone card offers fraud protection by zero fraud liability Mastercard ensures fraud protection in case your card happens to be lost or stolen. Report lost or stolen Milestone Card immediately.

Can I manage my Milestone Mastercard account online?

Absolutely, you can manage Milestone card account by using secure login MyMilestoneCard on Concora Credit app for online account management, including view Milestone Card statement and make a payment.

How can I contact Milestone Customer Service?

You can contact the customer service, by Calling the customer service phone number or use Milestone Card email support via MyMilestoneCard login page.

Where should I send my Milestone Mastercard payment?

You can send your Milestone Mastercard payment by Mail Milestone credit card payment to the payment mailing address listed on Concora Credit app. Schedule a payment online for faster processing.

What is the FAX number for the Milestone Mastercard?

The FAX Number for the Milestone Mastercard Customer service is :1-503-268-4711

How do cardholders manage accounts?

To manage accounts cardholders use the MyMilestoneCard portal for 24/7 account access.

What’s the milestone card phone number?

The milestone card phone number is 1-800-224-4960, present on mymilestonecard.com for support.

Need help with Milestone card account?

If you need help with Milestone card account Contact customer service email for help with mymilestonecard account.

Can I use myfinanceservice login?

Yes, you can use myfinanceservice login via Concora Credit for account management.

These FAQs answered key Milestone Mastercard queries, from credit card eligibility to fraud protection. Check the MyMilestoneCard Login page for more common questions or customer support.

Conclusion

Your MyMilestoneCard login unlocks a world of credit builder credit card power, and I’ve walked you through it all. It’s one best credit builder credit card for rebuilding credit. Years ago, I stumbled through card logins, but now I’m guiding you to ace secure login MyMilestoneCard! You learned about benefits, Concora Credit app sections, payments, activation, and more across sections, like applying, managing accounts, and dodging scams.

This no security deposit required card helps build credit effortlessly. With 24/7 account access, don’t miss the chance to master Mastercard benefits. Keep this guide handy, and your MyMilestoneCard login will always be smooth and secure.